Find out if and how crypto can help protect your savings against inflation.

Globalized economies mean that events in one country can have a ripple effect on the rest of the globe. To encourage trade and investment, governments in most countries try to maintain a balanced international economic environment. Currency devaluation is one of the many ways governments try to maintain this balance.

What exactly is currency devaluation? Does it benefit the country’s economy? Are there any negative consequences? How can investors avoid these negative effects? What role does cryptocurrency play when currency devaluation occurs? We will answer all of these questions in this article.

Currency devaluation

Many years ago, currencies from many countries adhered to a “gold standard”. Currencies included the US dollar were backed with gold. The US dollar was allowed to be converted into gold. An ounce of this precious metal cost $20.67 at the start of the 20th Century. The price of this precious metal was reduced to $20.67 in the 1930s, and then lowered to $35 an ounce by the middle of the 1930s.

The gold standard was abandoned completely during the Nixon presidency (1969-1974). As a result, the price of gold rose dramatically. One of the most important economic consequences was that currencies around the world could freely float against one another. They no longer had to be regulated by any standard. This allowed governments to adjust the currency exchange rates in a way that was more convenient. Currency devaluation is a deliberate decrease in the currency value of a country.

Why do some governments choose currency devaluation?

Contrary to popular belief, a strong currency does not always make a better option for a country’s economy. A strong currency can make it difficult for a country to attract foreign investment because goods and services will be more costly for foreigners. Although the purchasing power of the local population is greater than it is abroad, this would not make the country economically more competitive.

Foreign investors would see the country as cost-effective and therefore increase capital inflows to the economy. This would result in the creation of more jobs, exports, as well as general economic growth.

Is Currency Devaluation a Negative Event?

While currency devaluation may be beneficial for the country’s economy, it can also have some adverse effects. Inflation is the most serious negative effect of currency devaluation. Imports become more expensive when the currency is weaker. End consumers will demand locally-produced products and services, which would lead to a weaker currency. However, if local producers are unable to meet growing demand, prices for local products and services will also rise.

Devaluation of currency also tarnishes the image and strength of the economy. Devaluation can attract foreign investment but it can also raise doubts about the country’s economic strength. Foreign investors could lose faith in the country’s ability to achieve economic growth and may be less inclined to invest if the currency is constantly devalued. Foreign debt holders could also suffer losses due to the necessity of exchanging payments in a currency that is devalued. The end result could be opposite of what was originally intended.

Traditional Hedges Against Currency Devaluation

National investors are concerned about currency devaluations, which can lead to uncertainty in the future of their investments. Investors have used different commodities and assets over the years to protect their investments from inflation and other negative effects. What are the best hedges? Below is a list of the top hedges against devaluations.

- Precious metals. Gold and silver have held their value through economic turmoil in the past. These commodities are considered the best protection against inflation. Investors usually store physical reserves of these precious metals as bullion coins in bars.

- ETFs are exchange-traded funds. ETFs are often used by investors as an alternative to holding large quantities of bullion coins. ETFs are available for silver and gold. The fund holds precious metals physically, while investors receive derivative contracts that are backed by gold or silver. It is much easier to hold a piece paper than metal bars at home.

- Commodities. Acquiring commodities is one of the best ways to hedge against inflation. The most popular hedges are metals, oil and fuel, livestock, agricultural products, and energy. These commodities are usually priced according to inflation which protects investments’ value. These commodities can be traded as options, contracts, or ETFs.

- Real estate. Property and land are tangible assets that can be held indefinitely. These assets can also increase in value and provide returns for investors. Additional income can be generated if the owner rents or leases their real estate.

Cryptocurrency: A New Hedge Against Currency Devaluation

The 2009 release of Bitcoin led to the creation of a new asset: cryptocurrency. Bitcoin and other cryptocurrency have gained acceptance over the years as hedges against currency devaluation. Because it can store value, Bitcoin is often called the “digital golden” Due to its limited supply (a maximum of 21 million digital bitcoins), the Bitcoin price will only rise as many coins are in circulation.

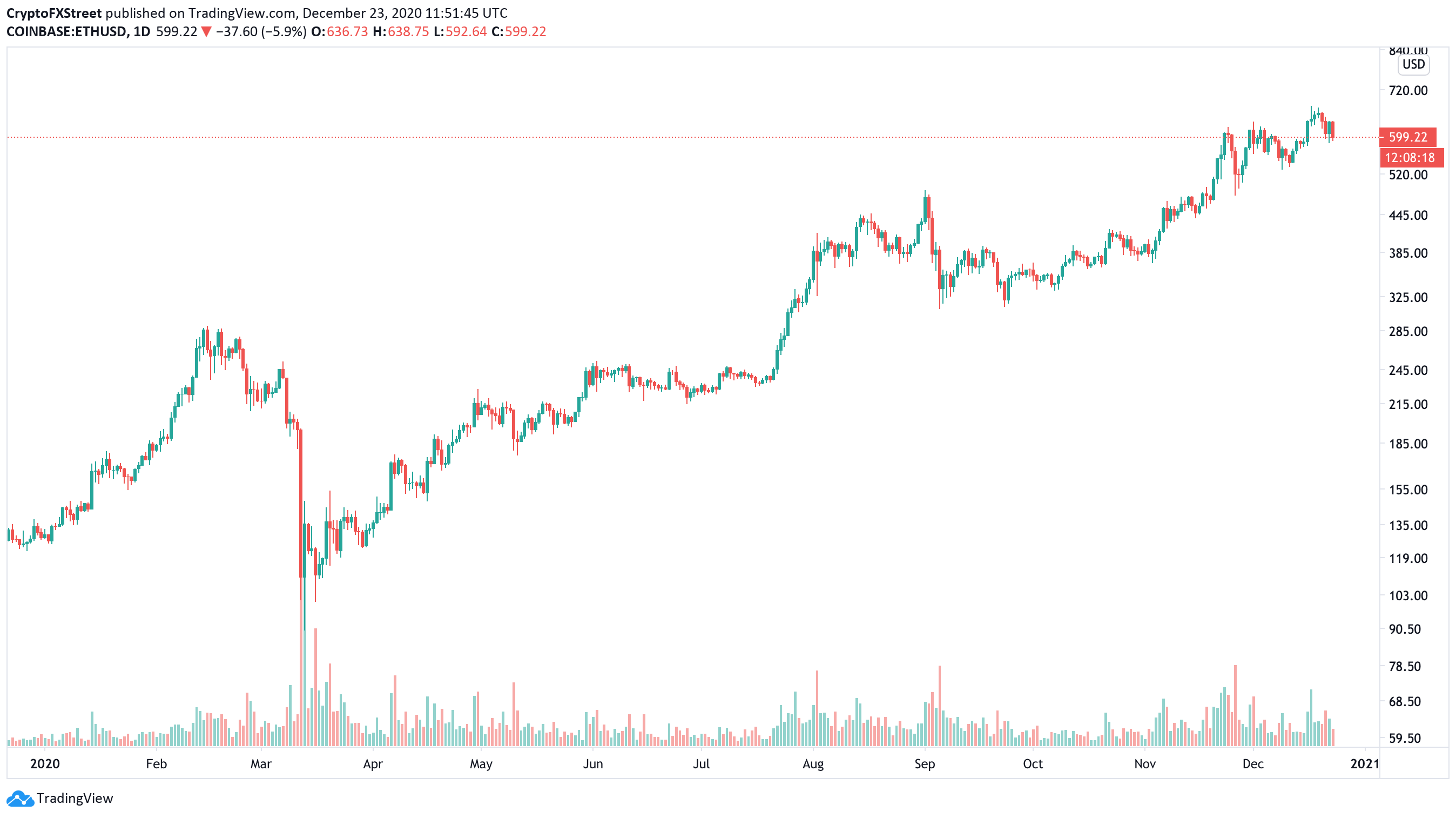

Bitcoin is also highly liquid. Bitcoin can be traded on numerous exchanges that are open 24/7. The number of brick-and-mortar and online businesses accepting Bitcoin is steadily increasing. Others cryptocurrencies, such as Ethereum, are also considered to be effective hedges against inflation.

Diversifying your crypto holdings is the best way to protect cryptocurrency investments. An instant exchange service such as, which has over 350 digital tokens and coins, allows you to diversify. Our platform allows you to buy and sell cryptocurrency without any liquidity issues. It’s simple, secure, reliable, and easy.

Is it possible?

Many cryptocurrencies can be used as hedges against currency devaluation and inflation. They should be used together with traditional hedges to be safe. There is no 100% protection against devaluation or its effects. The early days of cryptocurrencies are still very young. The industry is growing rapidly and looks promising, but cryptocurrencies can still be volatile and unpredictable. You should research every digital coin that you are considering adding to your financial portfolio.

Disclaimer

Keep in mind that this information is solely based on our observations. It is only intended for informational purposes. This information does not constitute financial advice or a forecast. You are responsible for your risk when investing in cryptocurrency.

No Comments